When considering a good or a service, depending on the selling price, there can be a costly tax rate added to the purchase amount. As a consumer, it’s helpful to know what you will be paying after the tax amount is added. As a business owner, it’s important to decide at what point you will implement the tax amounts.

The tax rate is a part of the selling price that is not always included on the sales invoice. For some products, such as software or services, the tax rate is a part of the contract. For other products, such as food, the tax rate is a part of the product description and is typically displayed on the website. When the tax rate is included on the sales invoice, it is a clear indicator to the consumer of the amount of tax. However, when the tax rate is not included on the sales invoice, it is a difficult task for the consumer to determine what the tax amount will be.

In this article, I will provide an overview of how the tax rate is included on the sales invoice. I will also cover how the tax rate can be implemented on the website and mobile apps. And how to calculate the tax rate using a free online sales tax calculator.

How the Tax Rate is Calculated on the Sales Invoice

When calculating the sales tax on the invoice, the sales tax rate is included in the price of the product. The tax rate is the portion of the sales price that is taxed. In the example below, the tax rate of 15.25% is the portion of the product that is subject to the tax. This rate is what is shown on the sales invoice.

The sales tax rate is calculated by the following formula:

Sales Tax Rate = Sales Price / Cost Price

The sales tax rate for each product is added to the sales invoice. In the example below, the total sales tax amount of $10 is calculated by multiplying the total sales price of $19.99 by the tax rate of 15.25%.

Total Sales Tax

In the following example, the total sales tax amount is calculated by adding the sales tax rate of the product to the cost price. In the example below, the total sales tax amount of $10 is calculated by adding the sales tax rate of the product to the cost price.

Calculating the total sales tax amount on the sales invoice is useful for businesses. It provides a clear indicator to the consumer of the total tax amount.

How the Tax Rate is Calculated on the Website and Mobile Apps

The tax rate can be calculated on the website or mobile app. This method is commonly used for online retailers who sell products to customers located outside of their state. The tax rate is calculated by the following formula:

Sales Tax Rate = (Product Cost Price – Product Cost Price) * Tax Rate

In the following example, the total sales tax amount of $10 is calculated by multiplying the total product cost price of $19.99 by the tax rate of 15.25%.

Total Sales Tax

In the following example, the total sales tax amount of $10 is calculated by adding the sales tax rate of the product to the cost price.

Calculating the tax rate on the website and mobile app is beneficial for consumers. It is helpful for consumers to know the total sales tax amount and to be able to see the tax rate that will be added to their purchase.

When deciding how to include the tax rate on the sales invoice, it’s important to consider what the sales tax rate is. This will provide a better understanding of how the tax rate will be added to the invoice.

The following example illustrates the sales tax rate of a product that has a total sales tax amount of $10. The tax rate is calculated by the following formula:

Sales Tax Rate = (Product Cost Price – Product Cost Price) * Tax Rate

In the example below, the total sales tax amount of $10 is calculated by adding the sales tax rate of the product to the cost price.

Using an online calculator to calculate Sales tax

You can use this online based Tax calculator to calculate the tax for the following states and cities;

- Calculate sales tax for New jersey

- Calculate sales tax for Missouri

- Calculate sales tax for NYC

- Calculate sales tax for Ohio

- Calculate sales tax for Carolina

- Calculate sales tax for Florida

- Calculate sales tax for Utah

- Calculate sales tax for Los Angeles

- Calculate sales tax for Virginia

- Calculate sales tax for Pennsylvania

- Calculate sales tax for Arkansas

- Calculate sales tax for Georgia

- Calculate sales tax for Washington

- Calculate sales tax for Michigan

- Calculate sales tax for Illinois

- Calculate sales tax for Arkansas

- Calculate sales tax for Arizona

- Calculate sales tax for Indiana

- Calculate sales tax for Maryland

- Calculate sales tax for Oklahoma

- Calculate sales tax for Nevada

- Calculate sales tax for Houston

- Calculate sales tax for colorado

- Calculate sales tax for Alabama

- Calculate sales tax for texas car

- Calculate sales tax for Dallas

- Calculate sales tax for Seattle

- Calculate sales tax for New Mexico

- Calculate sales tax for orange county

- Calculate sales tax for Iowa

- Calculate sales tax for San Diego

Note: While the cities and states are not available to be selected the parameters for the states are already bundled in the tool, so you only need to calculate your sales tax rate using the Tax-inclusive and Tax Exclusive format. You can not use this calculator to calculate sales tax by vehicle or by zip code.

How to Calculate the Total Sales Tax on the Sales Invoice

The total sales tax can be calculated in several different ways.

In the following example, the total sales tax amount of $10 is calculated by adding the sales tax rate of the product to the cost price.

Calculating the total sales tax on the sales invoice is useful for businesses. It provides a clear indicator to the consumer of the total tax amount.

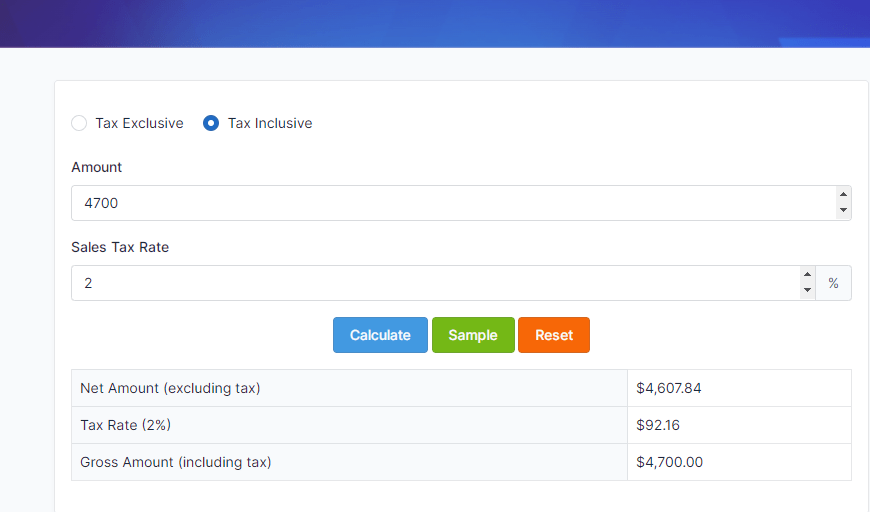

How to use the online sales Calculator to calculate Sales Tax

There are two variables here

- Tax Exclusive and

- Tax Inclusive see this article to see full details and explanation on this two terms.

Goto this online sales tax calculator

Select the first option Tax exclusive

Enter the amount you want then come down and select the Tax rate. You can then click on calculate. You will now see result.

For example let us use the Tax rate of 3 percent, and the net amount of $1000, see the result of the tax exclusive below;

| Net Amount (excluding tax) | $1,000.00 |

| Tax Rate (3%) | $30.00 |

| Gross Amount (including tax) | $1,030.00 |

For Tax inclusive, let take for example the Net amount is $4700 at the task rate of 2 percent, see the result below.